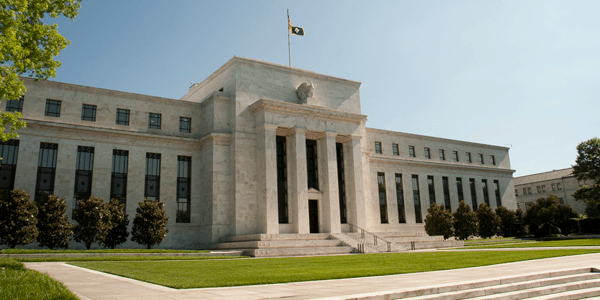

Wednesday April 24, 2024

Washington News

How Do You File Your Tax Return?

In 2020, H & R Block exited the program. This was followed by the departure in 2021 of Intuit, the parent company of the popular TurboTax program. The two major tax software providers had previously been selected by 70% of Free File users.

While there has been greater use of other tax software providers from the Free File Alliance, the "data shows that none of the current participating companies have replaced the volume of Free File users who previously used the Intuit website."

The GAO report indicates that the IRS should make plans for changes in the future. It states, "While the long history of the Free File program may make IRS officials believe it will continue, assuming that a program will continue is risky. By not managing these risks through the development of additional free online filing options for taxpayers, IRS may be unable to achieve its strategic goal to empower all taxpayers to meet their tax obligations."

The GAO suggested the IRS may want to consider developing other options, such as its own preparation software. The IRS has been reluctant to offer a public free filing option. The GAO noted that it may be difficult to build a high–quality software, but the IRS "may be understating its potential to improve certain aspects of the taxpayer experience."

The GAO report outlined the general usage of different tax filing methods by individuals. Those taxpayers with incomes under $72,000 qualify for the Free File program.

Taxpayer Filing Methods Per 100 Individuals

| Number of Taxpayers |

Filing Income | Filing Method |

|---|---|---|

| 29 | Over $72,000+ | Tax Preparer or Self-Prepared with Tax Software |

| 35 | Under $72,000 | Paid Tax Preparer |

| 22 | Under $72,000 | Self–Prepared with Tax Software |

| 7 | Under $72,000 | Refund Anticipation Loan |

| 3 | Under $72,000 | Paper Tax Return |

| 1 | Under $72,000 | Volunteer Inc. Tax Assist./Tax Counseling Elderly |

| 3 |

Under $72,000 | Free File Program |

Editor's Note: The IRS has been reluctant to develop a public free file software system. The companies with popular systems have two decades of software experience and it will be quite challenging for the IRS to provide a competitive product.